29 Jan 2026

- 9 Comments

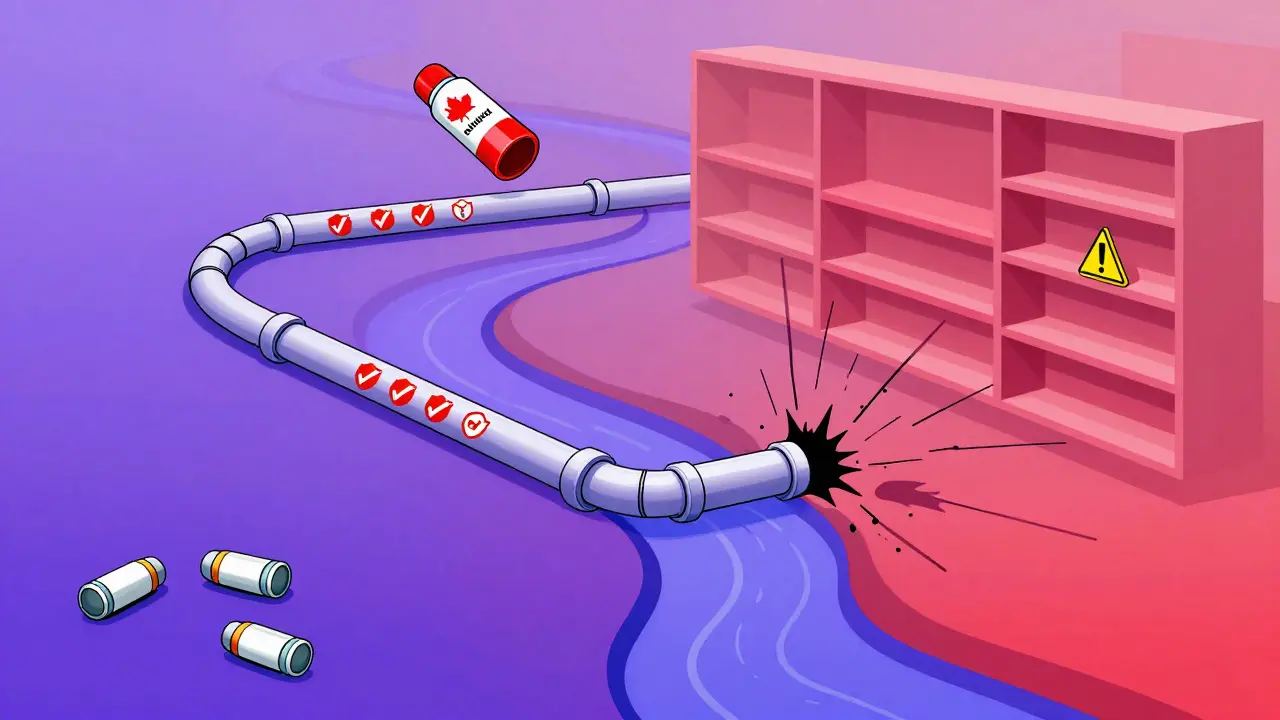

When you walk into a pharmacy in Canada and ask for a generic version of your medication, you might be surprised to find it costs more than the same drug in the U.S. That doesn’t make sense-unless you understand how the two systems were built from completely different ideas. Canada doesn’t let the market set prices. The U.S. does. And that single difference shapes everything: how much you pay, how often drugs run out, and even how fast new generics reach shelves.

Canada’s System: Price Control Through Collective Power

In Canada, the government doesn’t just regulate brand-name drugs-it coordinates the entire generic market. The pan-Canadian Pharmaceutical Alliance (pCPA) is the engine behind this. It’s not a single agency. It’s a coalition of all provincial and territorial drug plans, speaking with one voice to negotiate prices with manufacturers. This gives them massive leverage. When a patent expires on a drug like atorvastatin, the pCPA doesn’t wait for competition to kick in. It steps in immediately and sets a maximum price that pharmacies and public insurers must follow.This system started in 2010 and was renewed in October 2023 with a new three-year pricing framework. Since then, it’s saved Canadian public drug plans over $4 billion in a decade. The goal isn’t to drive prices to the lowest possible level-it’s to keep them stable, predictable, and affordable for everyone. That’s why, even though Canada has fewer generic manufacturers than the U.S., the system still manages to deliver savings.

But here’s the twist: the Patented Medicine Prices Review Board (PMPRB) only controls prices for brand-name drugs. Generics? They’re outside its reach. That creates a strange situation. Drug companies know they can’t raise prices on patented drugs, so they focus more on generics-where there’s no price cap. Some manufacturers have used that loophole to keep generic prices higher than they’d be in a truly competitive market.

The U.S. System: Competition Is King

In the United States, there’s no federal price control on any drug-brand or generic. Instead, the system relies on one thing: competition. When a patent expires, multiple companies rush to make the generic version. The first one gets 180 days of market exclusivity. After that, the floodgates open. Dozens of manufacturers enter the market. Prices plunge-often by 80% to 90% within six months.That’s why, on average, generic drugs in the U.S. cost 68% less than in Canada, according to PharmacyChecker’s 2023 analysis of 34 top-prescribed generics. In some cases, the same pill costs $12 in the U.S. and $45 in Canada for a 90-day supply. That’s not a fluke. It’s the result of a market where 7.3 manufacturers, on average, produce each generic drug. In Canada, it’s only 3.8.

The U.S. system rewards speed and scale. Companies compete not just on price, but on distribution networks, mail-order services, and discount programs like GoodRx. Consumers can save money by shopping around-checking prices at CVS, Walmart, and online pharmacies. But that also means more work for patients. Sixty-three percent of Americans have to check three or more pharmacies to find the lowest price.

Why Are Canadian Generic Prices Higher Than You’d Expect?

It’s counterintuitive. Canada has universal healthcare. It has centralized buying power. So why are some generics more expensive than in the U.S.?The answer lies in market size. Canada has about one-tenth the population of the U.S. That means fewer sales per manufacturer. Fewer sales mean less incentive for companies to enter the market. And fewer competitors mean less downward pressure on prices. A 2022 Fraser Institute study found that 33.3% of generic drugs in Canada actually cost more than in the U.S.-all of them generics, none brand-name.

Another factor: the time it takes to get a generic approved. In the U.S., the FDA moves quickly. In Canada, Health Canada’s process is thorough-and slower. The pCPA’s price negotiation alone can take 18 to 24 months after a patent expires. That delays the drop in price. Meanwhile, in the U.S., prices start falling within weeks.

But here’s what most people miss: Canada doesn’t measure success by the lowest price. It measures success by access and stability.

Shortages: Canada Wins, U.S. Struggles

When a critical drug runs out, who handles it better?Canada does. In 2022, during the nationwide albuterol inhaler shortage, Health Canada stepped in. It tracked supply chains, coordinated with manufacturers, and prioritized hospitals in high-need areas. A nurse in Calgary told her story on Allnurses.com: her hospital got the supply it needed. Her sister’s hospital in Seattle didn’t get any for weeks.

That’s not an accident. Canada’s system is designed to prevent shortages. Health Canada monitors drug supply in real time. It has a formal process to flag and respond to risks. The U.S. FDA, by contrast, reacts after shortages happen. Research in JAMA Network shows that sole-source drugs-those made by only one company-are 2.5 times more likely to go out of stock in the U.S. than in Canada.

And here’s the kicker: over 90% of all drug shortages in both countries involve generics. But Canada’s approach-limiting prescriptions to 30-day supplies, allowing private-label versions, and encouraging backup suppliers-keeps patients covered during crises. In a 2023 survey, 68% of Canadian patients reported no access issues with essential generics. In the U.S., that number was 49%.

Who Pays? Who Benefits?

In both countries, about half of prescriptions are paid for by public insurance, half by private plans. But the way money flows is different.In Canada, public plans pay the bulk of the cost for generics. That’s why the pCPA’s price negotiations matter so much. Private insurers often follow the public plan’s price as a benchmark. In the U.S., private insurers negotiate separately with pharmacies and pharmacy benefit managers (PBMs). That creates a patchwork of prices, where the same drug can cost $5 at Walmart and $50 at a specialty pharmacy.

Canada’s per capita spending on prescription drugs in 2021 was $814. The U.S. was $1,432-nearly double. That gap exists because Canada controls the biggest cost driver: brand-name drugs. Generics may cost more here, but they’re only a small part of the total bill. The real savings come from capping prices on expensive patented medicines.

And while Canada’s generic dispensing rate is 83% (lower than the U.S.’s 90%), that’s not because Canadians avoid generics. It’s because new generics take longer to arrive. Canada adopts new molecular entities 8.2 months slower than the U.S. That delay pushes patients toward brand-name drugs longer.

What’s Changing? What’s Next?

The U.S. is looking at Canada-not to copy it, but to borrow its stability.Vermont, Colorado, and soon Florida, are passing laws to import cheaper drugs from Canada. But Canada has pushed back. In January 2023, it launched the Supply Chain Resilience Framework to stop its own drug supplies from being drained by U.S. importers. Health Canada now monitors exports more closely to protect domestic access.

Meanwhile, Canada’s generic prices are expected to rise 15-20% by 2025 due to global supply chain pressures. The U.S. is projected to see generic prices drop another 5-8% annually through 2026.

Experts are divided. Dr. Donald Willison from the University of Ottawa says Canada’s price controls on brand drugs unintentionally inflate generic prices. Dr. David Henry from the Canadian Institute for Health Information counters that the system saves $37 billion a year overall. Harvard’s Dr. Steffie Woolhandler says the U.S. gets lower prices but at the cost of reliability.

The truth? Neither system is perfect. Canada sacrifices some price savings for security. The U.S. gets low prices but risks running out of critical drugs when supply chains break.

For patients, the choice isn’t about which country is better. It’s about what you value more: lower prices, or peace of mind that your medication won’t vanish when you need it most.

Why are generic drugs sometimes more expensive in Canada than in the U.S.?

Canada doesn’t rely on market competition to drive down generic prices. Instead, it uses centralized negotiations through the pCPA, which can take 18-24 months after a patent expires. With fewer manufacturers (3.8 per drug on average vs. 7.3 in the U.S.), there’s less pressure to lower prices. Some companies also shift focus to generics because brand-name prices are capped by the PMPRB, leading to higher generic prices than in the U.S.

Does Canada have drug shortages like the U.S.?

Canada has shortages, but they’re less frequent and resolved faster. Health Canada actively tracks supply chains and intervenes when risks arise-limiting prescriptions, approving backup suppliers, and prioritizing hospitals. In contrast, the U.S. FDA reacts after shortages occur. Studies show sole-source generic drugs are over twice as likely to run out in the U.S. as in Canada.

Can Americans buy drugs from Canada legally?

Federal law in the U.S. allows importation of drugs from Canada under strict conditions, but the Department of Health and Human Services has never approved a program. Some states like Vermont, Colorado, and Florida have passed laws to import drugs from Canada, but none are operational yet. Canada has responded by tightening export controls to protect its own supply.

Which system saves more money overall: Canada or the U.S.?

Canada saves more overall. While U.S. generic prices are lower, Canada controls the cost of expensive brand-name drugs through the PMPRB. In 2021, Canada spent $814 per person on prescription drugs-nearly half of the U.S.’s $1,432. Generics in Canada may cost more, but they make up a smaller share of total spending. The pCPA has saved over $4 billion in a decade just on generics, and $37 billion annually across all drugs.

Do Canadian pharmacists handle generics differently than U.S. pharmacists?

Yes. Canadian pharmacists must navigate a tiered pricing system with three price levels based on competition, and they often deal with complex provincial rules. They spend 5-7 hours a week managing price-related issues. U.S. pharmacists focus more on formulary restrictions from multiple private insurers and spend 3-4 hours a week on similar tasks. But U.S. pharmacists face more pressure from patients asking for the cheapest price across dozens of pharmacy chains.

Carolyn Whitehead

January 30, 2026Honestly I never thought about why my generic meds cost more in Canada until I visited my aunt in Toronto. She showed me her prescription receipt and I was like wait what? But then I realized she never runs out of stuff even when there’s a shortage. That’s worth something.

Amy Insalaco

February 1, 2026The structural inefficiencies inherent in Canada’s centralized pharmaceutical pricing architecture are not merely a function of reduced market competition but rather a systemic misalignment between price-setting mechanisms and demand elasticity. The pCPA’s interventionist paradigm, while ostensibly promoting equity, inadvertently engenders rent-seeking behavior among manufacturers who exploit the absence of price ceilings on generics-a phenomenon empirically corroborated by the Fraser Institute’s 2022 longitudinal analysis. This is not a flaw in policy design; it is a predictable outcome of suppressing price signals in a complex, multi-layered oligopolistic market.

Katie and Nathan Milburn

February 2, 2026It is important to recognize that the Canadian system prioritizes systemic stability over individual transactional cost. While the United States achieves lower per-unit prices through competitive dynamics, it does so at the expense of supply chain predictability. The data regarding sole-source drug shortages, as documented in JAMA Network, presents a compelling case for the resilience of centralized coordination. One cannot evaluate pharmaceutical policy solely on the basis of price per pill without considering the broader public health implications.

Marc Bains

February 2, 2026As someone who’s worked in pharmacy systems across both countries, I’ve seen how this plays out on the ground. In the U.S., patients are stuck playing price detective-checking CVS, Walgreens, Walmart, GoodRx, mail-order-it’s exhausting. In Canada, you show up, you get your script, and you know it’ll be there next month too. Yeah, it might cost a bit more, but you’re not stressing about whether your blood pressure med will vanish next week. That peace of mind? Can’t put a price on that.

kate jones

February 3, 2026The distinction between price control and supply chain governance is often conflated. Canada’s PMPRB regulates brand-name drugs, creating a disincentive for manufacturers to invest in generic innovation within its borders. Meanwhile, the pCPA’s 18–24 month negotiation window introduces a lag that artificially constrains market entry. The U.S. model, while fragmented, accelerates generic adoption through FDA expedited pathways and market-driven competition. The 83% generic dispensing rate in Canada is not a reflection of patient preference but of systemic delay. Structural reform is needed-not nostalgia for centralized control.

Yanaton Whittaker

February 4, 2026USA BEST! 🇺🇸 Why are we even talking about this? Canada’s system is just socialism with pills. We got competition, we got choice, we got LOW PRICES. If you can’t find a cheap pill in America, you’re not trying hard enough. Stop copying Canada, we don’t need their slow, overpriced bureaucracy. #MakeGenericsCheapAgain

Jodi Olson

February 6, 2026It’s funny how we measure success by price when the real metric is whether you can still get your medicine when your life depends on it. The U.S. system is brilliant at driving down costs until it isn’t. Then you’re left with a single manufacturer, a broken supply chain, and a hospital without albuterol. Canada doesn’t optimize for the lowest number. It optimizes for continuity. Maybe we need to ask: what’s the cost of a life lost because a pill disappeared?

Sazzy De

February 6, 2026I used to think Canada was just being slow. But after my mom had that asthma attack and her inhaler was gone for weeks in Florida while her cousin in Ontario got hers without issue… I get it now. Sometimes you don’t want the cheapest. You want the one that’s there.

Rohit Kumar

February 6, 2026As someone from India where drug pricing is a chaotic mix of regulation and black markets, I see both systems as extremes. Canada’s model reminds me of how our public hospitals ration drugs-predictable but slow. The U.S. feels like our private clinics: fast, cheap, but only if you can pay or hustle. The real lesson? No system is perfect. But the one that keeps you alive when you’re vulnerable? That’s the one worth keeping.